How a $100 Birthday Gift Can Create a Million-Dollar Future

This post helps you to visualize the impact of making giving $100 birthday gift

KIDS FINANCE

Mr. Idiot

12/21/20242 min read

Hi, I am Mr. Idiot and I help people visualize their 'Financial Future' to inspire them for baby steps.

Who is the intended audience for this blog? Primary Audience : Parents of young children who whats to see his or her children do well in their life.

What is in this blog? This blog will help you to visualize the impact of investing $100 on your child's birthday till the time they are 18 years age.

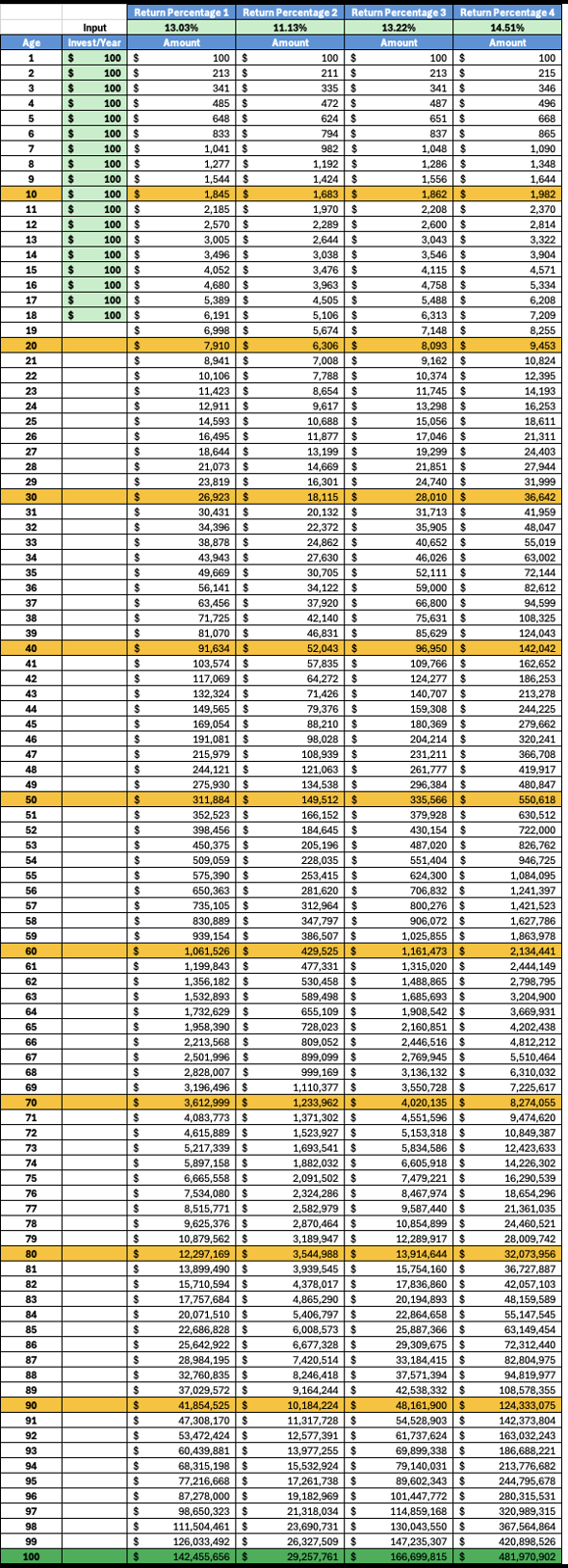

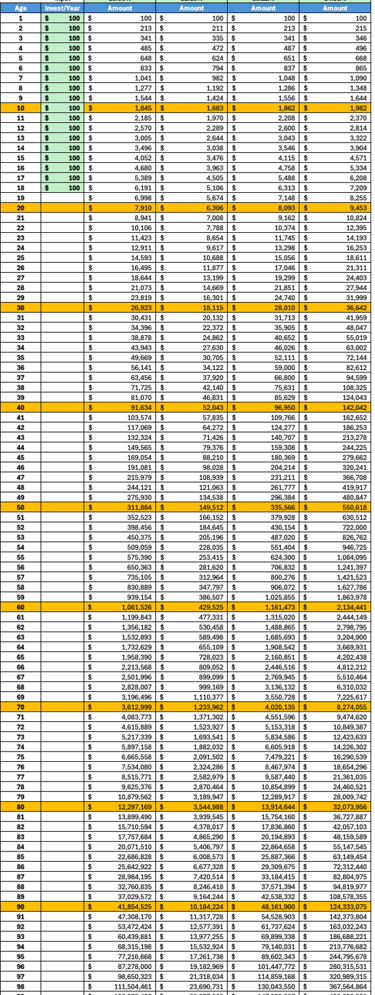

Visualization Created for Sophie : Julie is 28 years old and mother of a new born Carrie i) If she invest $100 on every birthday till the time Carrie becomes 18. What will be Carrie's balance by age and what will be Carrie's balance at the age of 100?

With 11.13% return, Carrie or Carrie's family would have $29 millions+ and with 14.51% return it will be $481 Million dollars+ when she will be celebrating her 100th birthday.

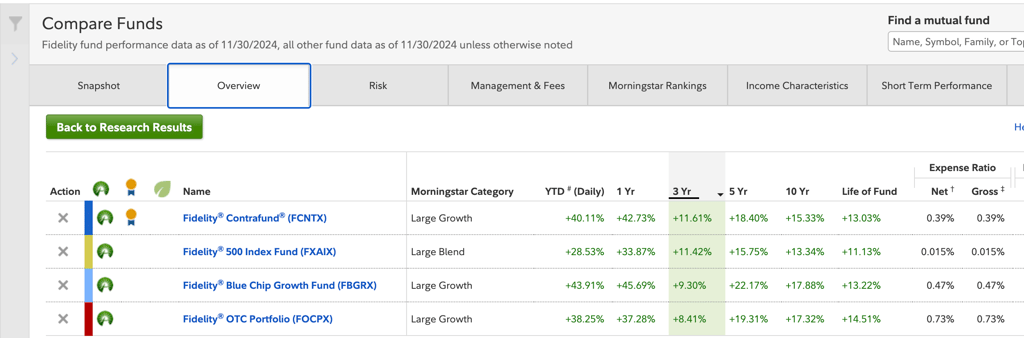

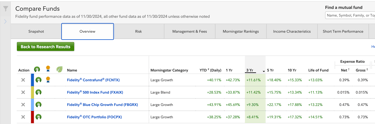

The above table is the projection of the balance by the age considering different lifetime return percentage of four (4) Fidelity Funds which are in existence for more than 30 years.

I hope this was helpful for you to visualize it . How early investment can generate significant wealth.

I invest with Fidelity. If you're interested in opening an account, please use the link below.

If you think this article was thought provoking, please share it with your family & friends.

Thank you and keep building your legacy through Generational Wealth! Take care and don't forget to enjoy the journey and take care of your health.

Note : Please note that the calculations are estimates based on certain assumptions, such as variable annual returns. This blog post is intended to illustrate the potential long-term benefits of consistent saving and investing, not to provide specific financial advice. The information presented on this blog, including any visualizations or projections based on historical data, should not be considered financial advice. Investing involves inherent risks, and the value of investments can fluctuate significantly.

Just Be Wealthy

© 2025. All rights reserved.

100% of the earnings we generate through our affiliate program will be donated to charity.